oklahoma auto sales tax rate

The Choctaw Oklahoma sales tax is 875 consisting of 450 Oklahoma state sales tax and 425 Choctaw local sales taxesThe local sales tax consists of a 425 city sales tax. Whether you live in Tulsa Broken Bow or Oklahoma City residents are required to pay Oklahoma car tax when purchasing a vehicle.

Sales Tax Laws By State Ultimate Guide For Business Owners

2022 Oklahoma state sales tax.

. An 11 titling fee. This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Motor vehicle excise tax.

609 rows Oklahoma Sales Tax. To calculate the sales tax on your. A 4 VIN inspection fee for usedout-of-state vehicles.

This page covers the most important aspects of Oklahomas sales tax with respects to vehicle purchases. Tag Tax Title Fees Unconventional Vehicles Boats Outboard Motors Rules Policies IRP IFTA 100 percent Disabled Veterans Sales Tax Exemption Motor Vehicle Exemption Ad. For a used vehicle the excise tax is 20 on the first 1500 and 3 ¼ percent thereafter.

Find Your States Vehicle Tax Tag Fees When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. A 17 title transfer fee for a newly purchased vehicle. How to Calculate Oklahoma Sales Tax on a New Car.

The Oklahoma sales tax rate is currently. The Oklahoma state sales tax rate is 45 and the average OK sales tax after local surtaxes is. The sales tax rate for the Sooner City is.

The county the vehicle is registered in. The excise tax is 3 ¼ percent of the value of a new vehicle. That must be added to the city tax and the State Tax.

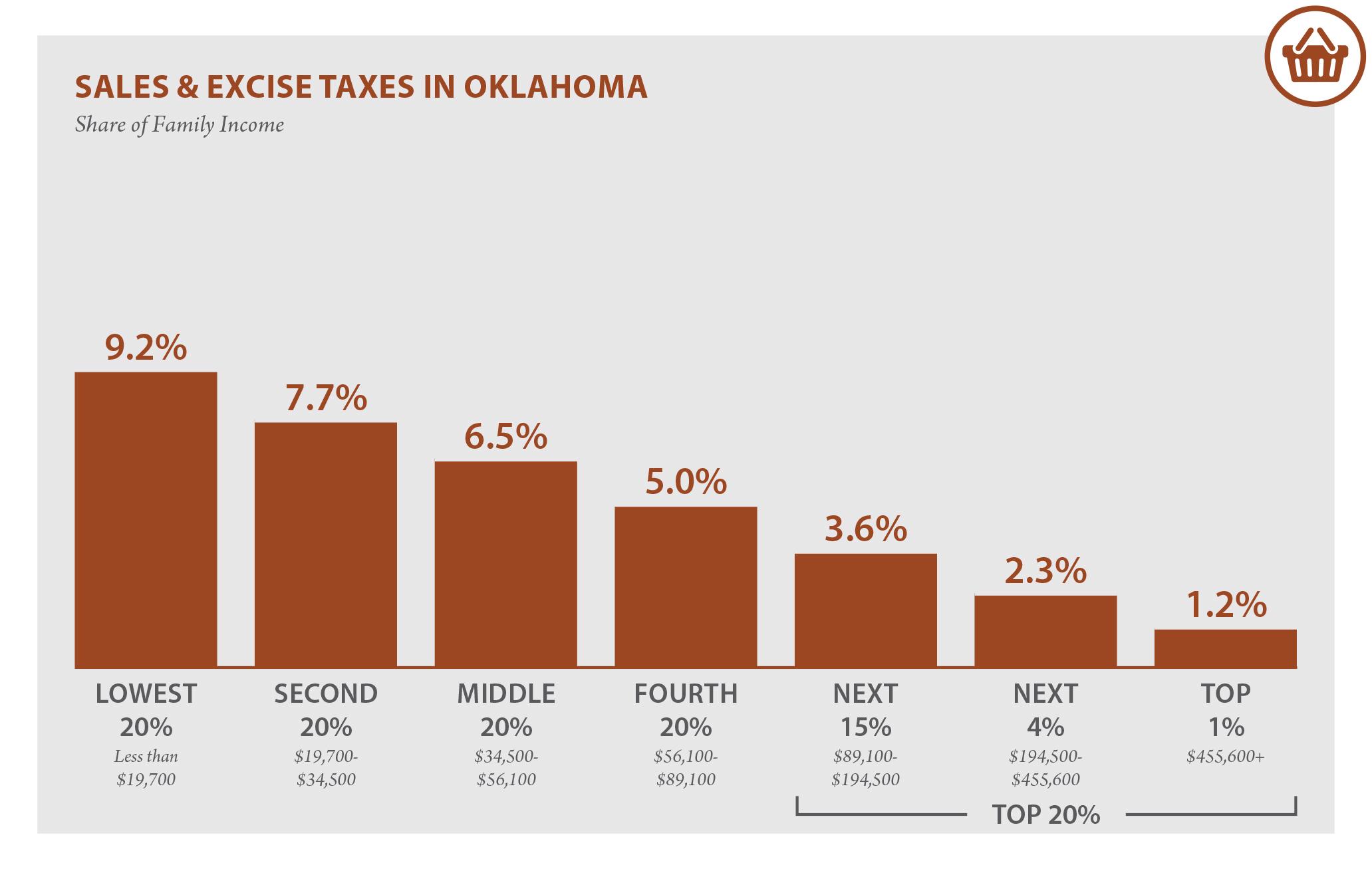

The minimum combined 2022 sales tax rate for Yukon Oklahoma is. The normal sales tax in Oklahoma is 45 but all new vehicle sales are taxed at a flat 325. For vehicles that are being rented or leased see see taxation of.

0188 adair cty 175 0288 alfa cty alf 2 0388 toka cty a 175 0488 beaver cty 2 0588 beckham cty 035 0688 blaine cty 0875 0788 yan cty br. Oklahoma also has a vehicle excise tax as follows. 4525 Idabel 3 to 4 Sales and Use Increase July 1 2022 0636 Longdale 3 Use New July 1 2022 3613 Newkirk 3 to 4 Sales and Use Increase July 1 2022 6351 Shawnee 5.

This is the total of state county and city sales tax rates. Businesses can check the Oklahoma Tax Commissions page for new and updated lodging taxes. Oklahoma has state.

Charges two taxes for the purchase of new motor vehicles. This is the largest of Oklahomas selective. Oklahoma has a 45 statewide sales tax rate but also has 471 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 426.

The minimum combined 2022 sales tax rate for Woodward Oklahoma is. Average Sales Tax With Local. Oklahoma tax commission 0188 adair cty 175 0288 alfalfa cty 2 0388 atoka cty 175 0488 beaver cty 2 0588 beckham cty 035 0688 blaine cty 0875 0788 bryan cty.

The value of a vehicle is. There are special tax rates and conditions for used vehicles which we will cover later. A 96 motor vehicle registration fee.

With local taxes the total sales tax rate is between 4500 and 11500. Now Oklahomans purchasing a vehicle will have to. Exact tax amount may vary for different items.

Used vehicles are taxed a flat fee of. The Oklahoma sales tax rate is currently. This is the total of state county and city sales tax rates.

For vehicles that are being rented or leased see see taxation of leases and rentals. Motor vehicle taxes in Oklahoma are both selective sales taxes on the purchase of vehicles and ongoing taxes on wealth the value of the vehicles. 125 sales tax and 325 excise tax for a total 45 tax rate.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

State Sales Tax Rates 2022 Avalara

States With The Highest Lowest Tax Rates

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

Boomer Kia New Kia Sales Service In Oklahoma City Ok

If I Buy A Car In Another State Where Do I Pay Sales Tax

Sales Taxes In The United States Wikipedia

Taxes When Buying A Car Types Of Taxes Payable On A Car Purchase Carbuzz

Oklahoma City Tax Title License Fees

Oklahoma Vehicle Sales Tax Fees Calculator Find The Best Car Price

General Sales Taxes And Gross Receipts Taxes Urban Institute

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator

Penny Hike Would Make State No 1 In Sales Taxes

Used Vans In Oklahoma City Ok For Sale Enterprise Car Sales

Oklahoma Sales Tax Guide And Calculator 2022 Taxjar

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)

The Best And Worst States For Sales Taxes